Methodology

Key Facts

Overview

- Access to real time sustainable finance data and insights in the Middle East

- Benchmark sustainable finance data across organisations

- Generate insights by consolidating organisations

Universe

- Universe of organisations: Abu Dhabi Sustainable Finance Declaration Signatories and Gulf Cooperation Council (GCC) listed sustainability reporters

Approach

- Sustainable finance data is captured from publicly disclosed data (e.g., annual reports, sustainability reports, websites)

- All required data points are pre-populated

- Submissions from companies are not required

- Organisations are contacted for data verification

- Methodology is based on 50 key performance indicators (KPIs), divided evenly to cover five sustainable finance themes

- KPIs are grouped under five key themes: Responsible Banking, Responsible Investing, Sustainable Products, ESG Disclosure, and Sustainable Capital Markets

- KPIs are applicable in accordance to the organisation’s sector: banks, insurance, asset management, sovereign wealth funds, regulators, stock exchanges, financial centres.

Contact information and to learn more

If you would like to confirm the correct contacts for your organisation or have any questions or comments, please feel free to email us at: admin@sustainabilityexcellence.com

About ADGM Sustainable Finance Platform

The Abu Dhabi Global Market Sustainable Finance Platform is designed to accelerate the objectives of ADGM in promoting sustainable finance in the Middle East.

The Platform presents key sustainable finance data of the signatories of the Abu Dhabi Sustainable Finance Declaration, as well as Gulf Cooperation Council (GCC) listed sustainability reporters. In addition to trends related to five sustainable finance themes - Responsible Banking, Responsible Investing, Sustainable Products, Sustainable Capital Markets, and ESG Disclosure - each of the sustainable finance themes covers 10 key performance indicators that are aligned with the ADGM's Sustainable Finance Guiding Principles.

The sustainable finance data has been captured, updated, and maintained by ADGM's partner - Sustainability Excellence - using information available in the public domain.

Key ADGM Sustainable Finance Platform Themes

1. Responsible Banking - Integrating ESG Factors in Lending Activities

Applicable for Banks

The banking sector plays a critical role in creating a sustainable future by adopting sustainable financing practices to ensure that economic development does not come at the cost of our ecosystems and our future generations. At the same time, it also makes business sense – protecting and adding value to their loan portfolios.

The Responsible Banking theme provides an overview of 10 key performance indicators that cover banks' commitments, targets, systems, financing practices and performance concerning the integration of environmental, social and governance (ESG) factors in lending activities.

Guiding reference: The Principles of Responsible Banking

2. Responsible Investing - Integrating ESG Factors in Investing Activities

Applicable for Banks, Insurance, Asset Management, Private Equity, Sovereign Wealth Funds

Responsible investing is the strategy and practice in incorporating ESG factors in investment decisions and active ownership.

The Responsible Investing theme provides an overview of 10 key performance indicators that cover financial services' commitments, targets, systems, investing practices and performance concerning the integration of ESG factors in investing activities.

Guiding reference: Principles of Responsible Investment

3. Sustainable Products - Green, Social, Sustainability, and SDG Bonds

Applicable for Bond Issuers

Sustainable financial products are designed to support environmental and social priorities by directing portions of the capital raised to projects with clear environmental and social benefits.

The Sustainable Products theme provides an overview of 10 key performance indicators that cover bond issuers' commitments, targets, systems, and performance related to the issuance of green, social, sustainability, and SDG bonds.

Guiding reference: International Capital Market Association

4. ESG Disclosure – Disclosure of ESG Data

Applicable across all organisations

ESG disclosure on material sustainability issues is becoming critical in meeting the continuously evolving ESG data requirements of investors, ESG and credit rating agencies, banks, regulators, among other stakeholders.

The ESG Disclosure theme provides an overview of 10 ESG key performance indicators that are applicable across a wide range of industries and sectors.

Guiding reference: Global Reporting Initiative (GRI) , Sustainability Accounting Standards Board (SASB)

5. Sustainable Capital Markets - Integrating ESG Factors in Capital Markets

Applicable for Stock Exchanges, Regulators, and Financial Centres

Stock exchanges, financial centres, and regulators are playing an important role in advancing sustainability in capital markets and contributing to national priorities by creating an investment climate that is capable of attracting funds and encouraging sustainable investments.

The Sustainable Capital Market theme provides an overview of 10 key performance indicators that cover how stock exchanges, financial centres, and regulators promote ESG.

Guiding reference: Sustainable Stock Exchanges Initiative

Key Performance Indicators

| # | KPI | Questions | Description | Unit | Applicability |

|---|---|---|---|---|---|

| Responsible Banking | |||||

1 |

Signatory to the Equator Principles (EP) (Yes/ No) |

Is your bank a signatory to the Equator Principles? |

The Equator Principles (EP) is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risk in projects and is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making. |

Y/ N |

Banks |

2 |

Signatory to the Principles for Responsible Banking (Yes/ No) |

Is your bank a signatory to the Principles for Responsible Banking? |

The Principles for Responsible Banking are a framework for ensuring that signatory banks’ strategies and practices align with the vision society has set out for its future in the Sustainable Development Goals and the Paris Climate Agreement. |

Y/ N |

Banks |

3 |

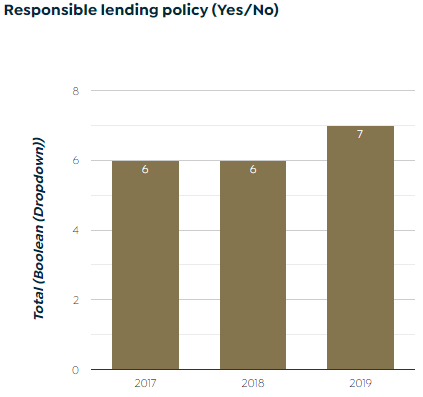

Responsible banking policy (Yes/ No) |

Does your bank disclose a formal responsible banking policy that covers Environmental, Social, and Governance risks? |

Disclosure of a stand-alone policy that reflects the bank's commitment to responsible banking. |

Y/ N |

Banks |

4 |

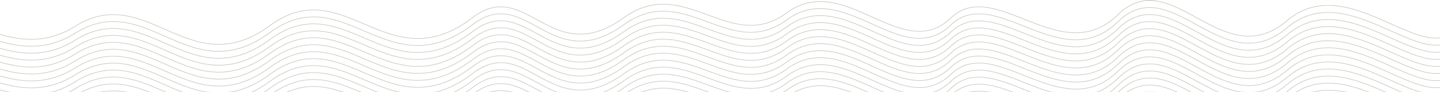

Lending targeted at key sectors with a net environmental impact (Million USD) |

What is the amount of lending targeted at key sectors with a net environmental impact? |

Lending targeted at projects with environmental benefits such as renewable energy projects, climate change solutions, sustainable water and wastewater projects, green building and biodiversity conservation projects. |

Million USD |

Banks |

5 |

Lending targeted at key sectors with a net social impact (Million USD) |

What is the amount of lending targeted at key sectors with a net social impact? |

Lending targeted at projects with social benefits such as affordable housing, food security, affordable basic infrastructure (e.g. clean drinking water, sewers, sanitation, transport, energy), access to essential services (e.g. health, education and vocational training, healthcare, financing and financial services) and socio-economic advancement and empowerment projects. |

Million USD |

Banks |

6 |

Commitment to integrate ESG factors in credit analysis (Yes/ No) |

Has your bank made a public commitment to integrate ESG factors in credit analysis? |

ESG integration is the analysis of all ESG factors in lending activities. |

Y/ N |

Banks |

7 |

Percentage of loans subjected to ESG screening (%) |

What is the percentage of loans subjected to ESG screening? |

Number of loans that underwent ESG screening as a percentage of total loans. ESG screening includes checking potential environmental, social and governance risks of a loan before approval. |

% |

Banks |

8 |

SME loans as a percentage of total lending (%) |

What is the percentage of SME loans relative to total lending? |

Loans provided to SMEs as a percentage of total loans. |

% |

Banks |

9 |

Target for financing green projects (Yes/ No) |

Does your organisation have a target set for financing green projects? |

Setting a quantitative target to finance projects with green benefits. Green projects categories include: renewable energy, energy efficiency, green buildings, pollution prevention and control, clean transportation, sustainable water and wastewater management, climate change adaptation, terrestrial and aquatic biodiversity conservation, environmentally sustainable management of living natural resources and land use and eco-efficient and/ or circular economy adapted products, production technologies and processes. https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bond-principles-gbp/ |

Y/ N |

Banks |

10 |

Target for financing social projects (Yes/ No) |

Does your organisation have a target set for financing social projects? |

Setting a quantitative target to finance projects with social benefits. Social projects categories include: affordable basic infrastructure, access to essential services, affordable housing, employment generation including through the potential effect of SME financing and microfinancing, food security and socio-economic advancement and empowerment. https://www.icmagroup.org/green-social-and-sustainability-bonds/social-bond-principles-sbp/ |

Y/ N |

Banks |

| Responsible Investing | |||||

1 |

Signatory to the Principles for Responsible Investment (PRI) (Yes/ No) |

Is your organisation signatory to the Principles for Responsible Investment (PRI)? |

The UN Principles for Responsible Investment is an organisation dedicated to promoting environmental and social responsibility among the world’s investors. The UN Principles for Responsible Investment relies on voluntary disclosures by participating members, called signatories. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

2 |

Responsible investment policy (Yes/ No) |

Does your organisation publicly disclose a responsible investment policy? |

Responsible investment policies can take many forms and there is no single right way of developing one. Policies can take the form of high-level statements on an organisation’s webpage, a code, a separate responsible investment policy document, a range of policy documents covering different areas, or in some cases are incorporated into an organisation’s Investment Policy Statement. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

3 |

Outline overall approach to climate-related risks (Yes/ No) |

Does your organisation publicly outline its overall approach to climate-related risks? |

Details on the climate related risks and opportunities that your organisation has identified and factored into its investment strategy and products. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

4 |

Dedicated ESG management committee (Yes/ No) |

Does your organisation have a dedicated ESG management committee responsible for oversight of ESG implementation? |

The objective of an ESG committee is to consider the material environmental, social and governance issues relevant to the business activities and support the company in maintaining its ESG performance. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

5 |

Total amount of assets under management (AUM) that incorporates ESG considerations (Million USD) |

What is the amount of assets under management (AUM) that incorporates ESG considerations? |

The total amount of assets under management (AUM) that integrate ESG considerations in the investment process. |

Million USD |

Asset Management, Sovereign Wealth Funds |

6 |

Total amount of assets under management (AUM) that incorporate Sharia screening considerations (Million USD) |

What is the amount of assets under management (AUM) that incorporate Sharia screening considerations? |

The total amount of AUM that integrate Sharia considerations in the investment process. |

Million USD |

Asset Management, Sovereign Wealth Funds |

7 |

Commitment to integrate ESG factors in investment decisions (Yes/ No) |

Does your organisation publicly disclose a commitment to integrate ESG factors in investment decisions? |

Disclosing a public commitment to integrate ESG factors in investment decisions. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

8 |

Engagement with investee to promote ESG disclosure (Yes/ No) |

Does your organisation publicly outline its ESG engagement approach? |

Including ESG topics in communications with investors. Engagement can either be private or public. Private engagements can be in any form from emails, letters, phone calls and in person meetings with company managers. The public engagement route is represented by a shareholder resolution, in which those who own a proportion of stock in the company are offered a free vote on ESG proposals put forward to them. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

9 |

ESG investment approach (Yes/ No) |

Does your organisation publicly outline its ESG investment approach? |

Description of how ESG factors are incorporated into investment analysis and investment decisions. |

Y/ N |

Asset Management, Sovereign Wealth Funds |

10 |

Specialised ESG/ Impact/ Thematic investment products/ funds (Yes/ No) |

Does your organisation offer specialised/ labelled ESG/ Impact/ Thematic funds? |

Themed investing allows investors to address ESG issues by investing in specific solutions such as renewable energy, waste and water management, sustainable forestry and agriculture, health products and inclusive finance. https://www.unpri.org/investment-tools/thematic-and-impact-investing |

Y/ N |

Asset Management, Sovereign Wealth Funds |

| Sustainable Products | |||||

1 |

Total amount of Social/ Sustainability/ SDG bonds proceeds (Million USD) |

What is your organisation's total issuance amount of Green/ Social/ Sustainability/ SDG bonds? |

Green bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/ or existing eligible green projects. Social bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance in part or in full new and/ or existing eligible social projects. Sustainability bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance in part or in full new and/ or existing eligible sustainability projects. https://www.icmagroup.org/green-social-and-sustainability-bonds |

Million USD |

Bond Issuers |

2 |

Total amount of Green/ Sustainability-linked loans issuance (Million USD) |

What is your organisation's total issuance amount of Green/ Sustainability loans? |

Green loans are any type of loan instrument made available exclusively to finance or re-finance, in whole or in part, new and/ or existing eligible green projects. Sustainability-linked loans are any type of loan instrument made available exclusively to finance or re-finance, in whole or in part, new and/ or existing eligible sustainability projects. https://www.lma.eu.com/application/files/9115/4452/5458/741_LM_Green_Loan_Principles_Booklet_V8.pdf |

Million USD |

Bond Issuers |

3 |

GHG emissions avoided annually from green financed projects (Tons) |

What are the estimated GHG emissions avoided annually from green financed projects? |

Estimated amount of GHG emissions avoided in projects financed by the bond proceeds (Tons). https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bond-principles-gbp |

Tons |

Bond Issuers |

4 |

Number of Green/ Social/ Sustainability/ SDGs bonds issued |

What is the number of Green/ Social/ Sustainability/ SDGs bonds issued by your organisation? |

Green bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/ or existing eligible green projects. Social bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance in part or in full new and/ or existing eligible social projects. Sustainability bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance in part or in full new and/ or existing eligible sustainability projects. https://www.icmagroup.org/green-social-and-sustainability-bonds |

Number |

Bond Issuers |

5 |

Total amount of green bonds proceeds (Million USD) |

What is the total amount of green bonds proceeds? |

Green bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/ or existing eligible green projects. https://www.icmagroup.org/green-social-and-sustainability-bonds |

Million USD |

Bond Issuers |

6 |

Total amount of green bonds proceeds allocated to green buildings projects (Million USD) |

What is the total amount of Green bonds proceeds allocated to green buildings? |

Total amount of Green bonds proceeds allocated to green building projects out of total bond amount issued. Green buildings are buildings which meet regional, national, or internationally recognised standards or certifications (LEED, BREEAM, HQE, CASBEE, Green Star, Estidama). |

Million USD |

Banks, Corporates, Government |

7 |

Total amount of Green bonds proceeds allocated to renewable energy projects (Million USD) |

What is the total amount of Green bonds proceeds allocated to renewable energy projects? |

Total amount of green/ social/ sustainability bonds proceeds allocated to renewable energy projects out of total bond amount issued. https://www.icmagroup.org/green-social-and-sustainability-bonds/ |

Million USD |

Banks, Corporates, Government |

8 |

Total amount of Green bonds proceeds allocated to sustainable water and wastewater management projects ( Million USD) |

What is the total amount of Green bonds proceeds allocated to sustainable water and wastewater management projects? |

Total amount of green bonds proceeds allocated to sustainable water and wastewater management projects out of total bond amount issued, including sustainable infrastructure for clean and/ or drinking water, wastewater treatment, sustainable urban drainage systems and river training and other forms of flooding mitigation. https://www.icmagroup.org/green-social-and-sustainability-bonds/green-bond-principles-gbp/ |

Million USD |

Banks, Corporates, Government |

9 |

Total amount of Green/ Social/ Sustainability bonds proceeds allocated in the MENA region (Million USD) |

What is the total amount of Green/ Social/ Sustainability Bonds/ Sukuks proceeds allocated in the MENA region? |

Total amount of green/ social/ sustainability bonds/ sukuks proceeds allocated in the MENA region out of total bond amount issued. https://www.icmagroup.org/green-social-and-sustainability-bonds/ |

Million USD |

Banks, Corporates, Government |

10 |

Total amount of Green/ Social/ Sustainability bonds proceeds allocated in the UAE (Million USD) |

What is the total amount of Green/ Social/ Sustainability Bonds/ Sukuks proceeds allocated in the UAE? |

Total amount of green/ social/ sustainability bonds/ sukuks proceeds allocated in the UAE out of total bond amount issued. https://www.icmagroup.org/green-social-and-sustainability-bonds/ |

Million USD |

Banks, Corporates, Government |

| ESG Disclosure | |||||

1 |

Sustainability Report (Yes/ No) |

Does your organisation publish a Sustainability Report/ and/ or Integrated Report? |

Sustainability reporting is the disclosure and communication of ESG goals—as well as a company’s progress towards them. The benefits of sustainability reporting include improved corporate reputation, building consumer confidence, increased innovation, and even improvement of risk management. https://www.globalreporting.org Integrated reporting engages all stakeholders, and allows a detailed, consistent, and transparent articulation of an institution’s performance and prospects. |

Y/ N |

All entities |

2 |

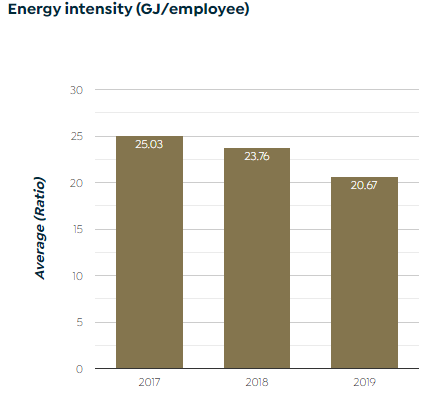

Percentage of women at the board level (%) |

What is the percentage of women at the board level? |

Number of women on board divided by total board members. |

% |

All entities |

3 |

Percentage of women in management positions (%) |

What is the percentage of women in management positions? |

Number of women in senior management positions divided by number of people in senior management. |

% |

All entities |

4 |

Percentage of women in the workforce (%) |

What is the percentage of women in the workforce? |

Number of women in the workforce divided by total workforce. |

% |

All entities |

5 |

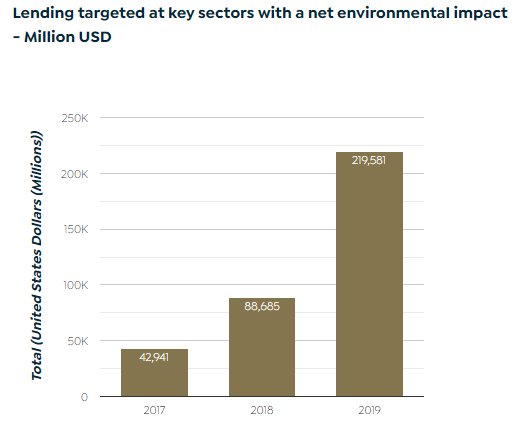

Energy intensity (GJ/ employee) |

What is your organisation's annual total direct energy consumption per employee? |

Total energy use in Gigajoules (GJ) divided by the total workforce. https://www.globalreporting.org/standards/media/1009/gri-302-energy-2016.pdf |

Ratio |

All entities |

6 |

GHG intensity (Tons/ employee) |

What is your organisation's total annual amount, in CO2 equivalents, for Scope 1, Scope 2 emission per employee? |

GHG emissions (tons) (Scope 1 + Scope 2) divided by total number of employees. Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy. |

Ratio |

All entities |

7 |

Training hours per employee (Hours/ employee) |

What is the annual ratio of training hours per employee? |

Number of training hours provided to employees divided by the total workforce. https://www.globalreporting.org/standards/media/1016/gri-401-employment-2016.pdf |

Ratio |

All entities |

8 |

Community investment as a percentage of pre-tax profit (%) |

What is your organisation's annual community investment amount as a percentage of pre-tax profit? |

Total amount invested in the community divided by the pre-tax profit. https://www.globalreporting.org/standards/media/1039/gri-201-economic-performance-2016.pdf |

% |

All entities |

9 |

ESG risks are reviewed at the board level (Yes/ No) |

Are ESG risks reviewed at the board level? |

ESG risks are covered in board meetings and/ or there is a sustainability/ ESG committee at the board-level. |

Y/ N |

All entities |

10 |

Turnover rate (%) |

What is the annual voluntary turnover rate? |

Number of voluntary leaves divided by the total workforce. https://www.globalreporting.org/standards/media/1016/gri-401-employment-2016.pdf |

% |

All entities |

| Sustainable Capital Markets | |||||

1 |

Deploys ESG related training (Yes/ No) |

Does your organisation deploy ESG related training? |

Supporting issuers understand the business case of ESG and the benefits of ESG reporting. |

Y/ N |

Stock Exchanges, Financial Centres, Regulators |

2 |

Facilitates listing of Green/ Sustainable Financial Instruments (Yes/ No) |

Does your organisation issue guidance for listing of Green/ Sustainable Financial Instruments? |

Supporting listed companies in listing green/ sustainable financial instruments. |

Y/ N |

Stock Exchanges, Financial Centres, Regulators |

3 |

Number of listed sustainability reporters |

What is the number of listed companies that have issued a GRI based sustainability report? |

Number of companies listed in the exchange that have issued a GRI-based sustainability/ Integrated report. |

Number |

Stock Exchanges |

4 |

Supports the development of ESG indices (Yes/ No) |

Has your organisation issued any ESG indices? |

Developing or supporting the development of ESG related indices or exchange traded funds (ETFs). |

Y/ N |

Stock Exchanges, Regulators |

5 |

Promotes SDGs in Capital Markets (Yes/ No) |

Does your organisation promote SDGs in capital markets? |

Initiatives deployed to promote key Sustainable Development Goals (SDGs) such as gender equality (SDG 5); decent work and economic growth (SDG 8); responsible consumption and production (SDG 12); and climate action (SDG 13). |

Y/ N |

Stock Exchanges, Financial Centres, Regulators |

6 |

Issues voluntary guidance on ESG reporting (Yes/ No) |

Does your organisation provide guidance on ESG reporting for listed companies? |

Issuing a guidance on ESG reporting to support listed companies' reporting on key ESG data. |

Y/ N |

Stock Exchanges, Regulators |

7 |

Partner to the Sustainable Stock Exchanges initiative (Yes/ No) |

Is your organisation a partner member to the Sustainable Stock Exchanges Initiative? |

The Sustainable Stock Exchanges initiative (SSE) is a UN Partnership Programme organised by UNCTAD, the UN Global Compact, UNEP-FI and the UNPRI. The SSE’s mission is to provide a global platform for exploring how exchanges, in collaboration with investors, companies (issuers), regulators, policymakers and relevant international organisations, can enhance performance on ESG issues and encourage sustainable investment, including the financing of the UN Sustainable Development Goals. |

Y/ N |

Stock Exchanges |

8 |

Promotes gender equality (Yes/ No) |

Does your organisation promote gender equality through regulatory requirements? |

Require or encourage listed companies to report on:

https://www.unpri.org/Uploads/g/z/q/How-stock-exchanges-can-advance-gender-equality.pdf |

Y/ N |

Stock Exchanges, Regulators |

9 |

Requires ESG reporting as a listing rule (Yes/ No) |

Does your organisation mandate ESG reporting as a listing rule? |

Setting mandatory requirements for ESG disclosure. |

Y/ N |

Stock Exchanges, Regulators |

10 |

Size of Green/ Social/ Sustainability Bonds/ Sukuk listed on the exchange (Million USD) |

What is the size of Green/ Social/ Sustainable Bonds/ Sukuk listed in your exchange? |

The amount of green/ social/ sustainability bonds/ sukuk listed in the exchange. https://www.icmagroup.org/green-social-and-sustainability-bonds/ |

Million USD |

Stock Exchanges |

Graph Interpretation

Data is represented in four different units; whole amounts, ratios, percentages and Yes/ No. Below is a short explanation of the graphs representing each unit.

1. Whole amount

Whole amount figures are illustrated in the graphs as the sum of all entries for each year. Example: Lending targeted at sectors with a net environmental impact for the year 2019 is 219,581 million USD for all companies that reported this indicator in 2019.

2. Ratio figures

Ratio figures are illustrated in the graphs as the average of all entries for each year. Example: Energy intensity average for the year 2019 is 20.67 (GJ/employee) for all companies that reported this indicator in 2019.

3. Percentages (%)

Percentage figures are illustrated in the graphs as the average of all percentage entries for each year. Example: Percentage of women at the board level for the year 2019 is 27.21 for all companies that reported this indicator in 2019.

4. Yes/ No

Yes and No answers are illustrated as the total organisations that reported “Yes” for the selected KPI for the specific year. Example: Ten companies reported “Yes” for disclosing a responsible investment policy in 2019.

Glossary of Terms

| Term | Definition | Reference |

| Abu Dhabi Global Market (ADGM) | Abu Dhabi Global Market (ADGM) is an international financial centre and free zone located in Abu Dhabi- UAE. ADGM has three authorities: the financial services regulator, the registration bureau and the ADGM courts. ADGM was established in 2013 by Abu Dhabi Chamber of Commerce and became fully operational in October 2015. | ADGM |

| Equator Principles | The Equator Principles (EP) is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risk in projects and is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making. | Equator Principles |

| ESG | Environment, Social and Governance. | Principles for Responsible Investment |

| ESG Disclosure | Reporting on relevant environmental, social and governance data. | Principles for Responsible Investment |

| Green projects | According to the ICMA, green projects categories include: renewable energy, energy efficiency, green buildings, pollution prevention and control, clean transportation, sustainable water and wastewater management, climate change adaptation, terrestrial and aquatic biodiversity conservation, environmentally sustainable management of living natural resources and land use and eco-efficient and/ or circular economy adapted products, production technologies and processes. | ICMA. |

| International Capital Market Association (ICMA) | ICMA is a not-for-profit membership association. Its members are private and public sector issuers, banks

and securities houses, asset managers and other investors, capital market infrastructure providers, central

banks, law firms and others. The objectives of the association are to promote good relations among its members and to provide a basis for joint examination and discussion of questions relating to the international capital and securities markets and to issue rules and make recommendations governing their operations; and to provide services and assistance to participants in the international capital and securities markets. |

ICMA. |

| Principles for Responsible Banking | The Principles for Responsible Banking are a framework for ensuring that signatory banks’ strategy and practice align with the vision society has set out for its future in the Sustainable Development Goals and the Paris Climate Agreement. | United Nations Environment Programme Finance Initiative |

| Responsible Investing | Responsible Investing is a strategy and practice to incorporate environmental, social and governance factors in investment decisions and active ownership. |

Principles

for Responsible Investment |

| Social projects | According to the ICMA, social projects categories include: affordable basic infrastructure, access to essential services, affordable housing, employment generation including through the potential effect of SME financing and microfinance, food security and socio-economic advancement and empowerment. | ICMA. |

| Sustainable Capital Markets | Sustainable Capital Markets are stock exchanges, financial centres who are contributing to national priorities by creating an investment climate that is capable of attracting funds and encouraging sustainable investments. | United Nations Environment Programme Finance Initiative |

| Sustainable finance | Sustainable finance refers to the process of taking due account of environmental, social and governance considerations when making investment decisions in the financial sector, leading to increased longer-term investments into sustainable economic activities and projects. | European Commission |

| Sustainable Products | Sustainable financial products are designed to support environmental and social priorities by directing portions of the capital raised to projects with clear environmental and social benefits. Sustainable financial products and services include ethical or sustainable investment funds, green loans, green/ social/ sustainable bonds. | ICMA |

| UN Principles for Responsible Investment | The UN Principles for Responsible Investment is an organisation dedicated to promoting environmental and social responsibility among the world’s investors. The UN Principles for Responsible Investment relies on voluntary disclosures by participating members, called signatories. | Principles for Responsible Investment |